Are you on track for a comfortable retirement?

A small adjustment today can make

a big impact tomorrow.

HAVE THE RETIREMENT YOU DESERVE.

Tailored to you

Make sure your super investments and insurances are tailored to suit your particular situation.

Your information is protected

We operate under the Privacy Act to ensure your information is safe and protected.

Helping thousands of Australians

We have helped thousands of Australians get their super working more effectively.

Easily contactable

No appointments needed! Our team are always ready to take your call.

Make sure you're on track

Find out if you’re on track for a comfortable and sustainable retirement today!

Award winning products

At Super Experts we only refer clients to firms that recommend award winning products.

CHECK HOW YOUR

SUPER IS TRACKING

With hundreds of Superfunds and thousands of different Investment Options inside each of the funds, comparing on your own can be hard to navigate and feel overwhelming. At Super Experts our partnered strategists give you peace of mind by doing all the comparisons, research and analysis for you. We can then explain clearly how your super can be better invested to achieve your financial goals and provide you the most comfortable retirement.

You work hard for your money, make sure it’s working hard and smart for you too.

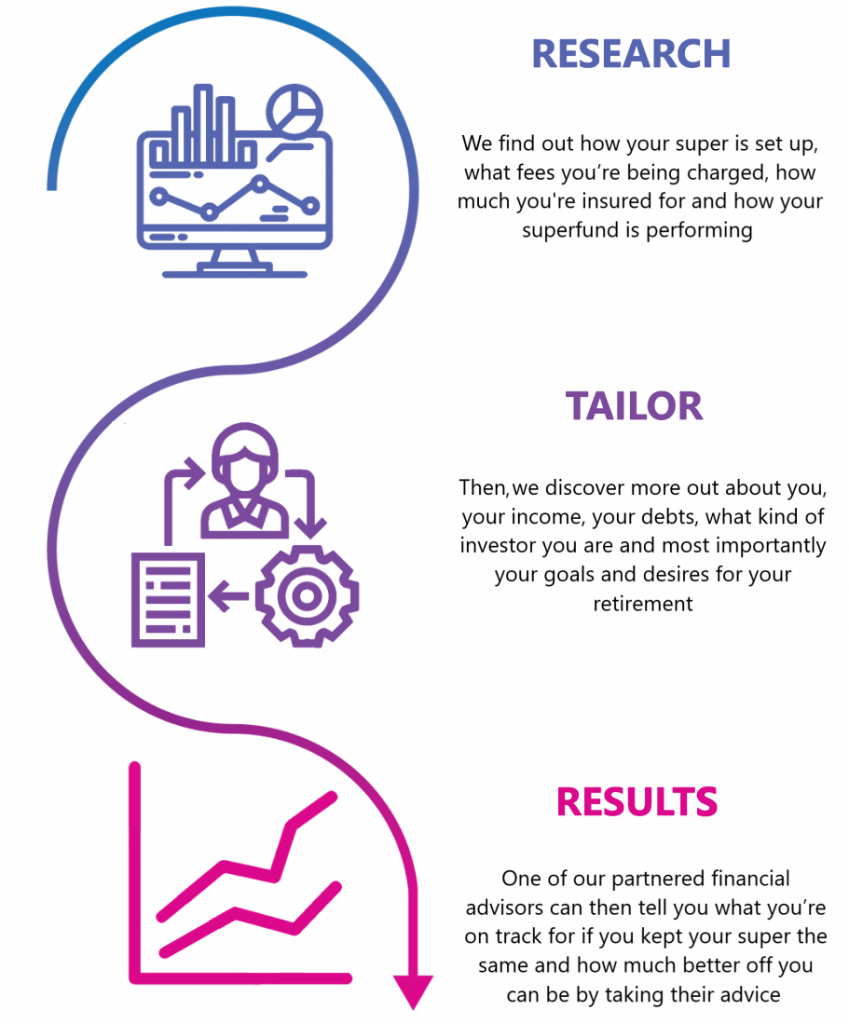

OUR SIMPLE 3 STEP PROCESS

Speak to one of our Experts today to find out what you’re on track to retire with.

LAtest News

New super rules: how Coalition changes will wrap industry funds in red tape

Analysis: ‘Your future, your super’ reforms would require all decisions to come with documentary evidence of how they benefit members financially…

ASIC sues REST Super for misleading conduct

The corporate watchdog has accused the $60 billion REST Super of misleading and deceptive conduct, alleging the industry superannuation fund…

Thirteen Australian superannuation funds fail performance test

Thirteen superannuation funds, including two associated with the Commonwealth Bank, that collectively hold the retirement savings of 1 million Australians…

FAQ's

Frequently asked questions and answers.

Originally, industry funds were created for those that work in a specific industry. For example hospitality workers use Host Plus, construction use CBUS and retail use Rest.

The money inside a persons industry fund isn’t then directly “reinvested into the industry”. Each superfund then has a different mixture of investments generally into things like the stock market, international stock market, property, cash and fixed interest.

However, the industry you work in has very little to do with your attitude toward investing and ultimately your goals for retirement. Some people prefer a more conservative approach while others want to make sure their money is working as hard and safe as possible to ensure a comfortable retirement.

A default investment option is a “one size fits all” approach to investing. Generally, a “default set up” refers to a clients Superannuation that may have been set up initially by an employer and has since never been looked at. Most funds have these options as an easy way for the employer to organise their employees super. However it is not always the best option for the employee. Superannuation has evolved since it was established and now there are so many different options. Some default set ups underperform against the standard needed to achieve a comfortable and sustainable retirement. Also everyone’s situation is different. You must make sure that you have the right options in place to suit your balance size, age, risk profile and your financial goals. The best way to know how your super is tracking is to get in touch and one of our experts will explain what options are available to improve your specific situation.

We understand most Australians don’t see their super as a problem. But unfortunately they didn’t teach any of us in school much about what to look for in a superfund. What makes a fund great or poor. We generally boil it down to three things: Fees, Returns, Risk.

There are many different types of fees you are currently paying that come out of your superannuation fund. Admin, Management Expense Ratios, Indirect Cost Ratios and Insurance Premiums to name a few. Most Australians don’t realise that on their statement generally it just reports the admin fee and insurances but what about the other costs to run the fund? Our experts will be able to outline exactly what the costs are that you may not be aware of.

Returns vary. What may have been a great performing fund a few years ago might now be underperforming. Just like what might be the best option today might not be forever. That is why it is essential to review your super frequently to make sure your strategy is still performing and you aren’t falling behind.

If you had $50,000 out of your pocket invested you would probably know where every single cent is. However do you know what your superannuation is invested in or how much risk and exposure to the markets you are currently taking? Most Australians don’t know how their superannuation is invested.

The worst case scenario after the review is that your super is working properly and nothing changes. At least then you have peace of mind knowing that you’re doing the right things. The best case scenario is that a small adjustment today means you don’t have to work for as long and can retire earlier, or with a lot more than you currently are. Find out today how your superfund works and what can be done to improve it.